Trading for a Living - Daniel Mankani

Trading For A Living – Daniel Mankani

(Manuscript) (draft July 2023, still in progress. New Book Coming!)

All rights Reserved. Copyright information.

Dynamic Trader – Trend Trading Dynamics.

Introduction – Trading successfully is a piece of art, a type of skill which develops and gets better over a long periods of time, it needs the courage of a fearless warrior who knows what’s lurking in the dark is still willing to getting into the woods where enemies and danger are lurking, such risks where one’s life may be the lost, yet determined to go in and win the big fight despite the odds. Such conviction needs deep faith and confidence earned and knowing oneself and knowing one’s own capabilities and skillsets makes this entire journey paramount.

Every past trade has lessons in them, win and loss is part of the game for personal growth and deep wounds and scars of the past are valuable experiences to cherish, the wins brought the ego, arrogance and reckless behavior which hits like pride before the fall and the fall continues till lessons are learned and humility is again established and earned.

Back in the old days when two kings had a dispute to settle, a duel would be called at the outskirts of the town and the rules of settlement were such, a duel a fight to the finish from dusk to dawn, two would fight till one man is last left standing with the winner taking the dead man's kingdom since he was dead, he would take his wife as his own and sell the dead kings children into slavery, Today, nothing much has changed the stakes of life are pretty much similar, if you lose your wealth you will lose your home and everything else with it, your wife will leave you and your kids will live in poverty akin to them becoming slaves to the grinds of life.

The Financial markets is increasingly similar, it’s a big mixed bag of emotions of various traders, all trying to out beat and out compete with each other for becoming the ultimate winner, these battles are on a daily and long-term basis with the key objective to build a fountain of wealth and a foundation of legacy. If you are wanting to be a successful trader, then it requires consistency in winning over long durations of time.

97% of all people who trade the markets lose money, most retail traders are too obsessively driven towards the market due to the ultimate feel of thrill and greed, they come into the market thinking if this could work then they would be able to live the life of the dreams, however as soon they start trading, this fictional thought process is exposed and with the emotional unpreparedness of such foolish thinking soon the joy of trading the markets turns into total destruction, panic and despair.

If you are ill equipped and have a lack of understanding of

what you are actually trading and lack the knowledge and passion for outperformance and competition, you are not going to last very long in this game

and my advice to many aspiring traders is if they could break even in their

first year of trading, its commendable since most unprepared traders will blow up their accounts within months and its indeed an

achievement to break even for up to one

whole year and it also proves you are passionate to becoming your best in your game.

For most traders whenever they trade demo account's, they are more likely to win and the game significantly changes when hindsight proves different in reality as the emotional intelligence takes precedence and once the losses hit, it becomes more of a chase to recover these losses but yet they multiply with more

and more reckless gambling behavior and while they acknowledge their small

wins, they are unable to acknowledge and take ownership of their overall

performance and losses.

The matter is made even worst with a whole of unscrupulous online gurus who pimp seminars and automated trading programs robots to exploit on people’s emotional state of greed with promises of instant riches and are nothing more than illegitimate scammers and criminals, people need to understand if indeed these promises of riches were true then why would someone sell these secrets of success, in fact successful traders are busy trading and have no time to do seminars or give away their secrets away for a song and even if you bought a book like this and thought you could replicate these results by finding a secret formula within these pages which you could replicate and be on your way to extreme riches, you will be fooling yourself in to believing this as you are seek shortcuts, akin to a lottery ticket and you will never be able to keep the money you haven’t earned as you do not exactly know why and how it was earned in the first place.

Don’t fall victim to this something for nothing mentality, a free lunch just doesn’t exist, these is just no replacement for continued self-reflection and hard work, only practice makes perfection and keep on practicing till you get the perfection.

The search for the holy grail, the magic of the alchemist to turn copper into gold has been a long ongoing process and these days hypothetical trading programs are pitched with performance results curve fitted on historical data and such analysis based on hindsight is a foolish person’s folly and even if the performance was based on real time results, it's still in the past as markets are dynamic and are always constantly changing into the future, what works in the past may not realistically reflect what will work in the future as for everyone who identifies such arbitraging opportunities will soon discover if others start doing the same thing, it's only a matter of time this arbitrating edge stops working.

Trading the financial markets is a very fulfilling experience, it’s exhilarating with its own sets of thrills, the ups and downs of emotions and it has a great potential to provide anyone with the life they desire, it offers the live-anywhere work-anywhere business model, Rewarding the participants with the ultimate lifestyle and beauty of taking holidays as and when wanted, it’s a business where you open shop and close shop whenever you want, you can determine your own working hours, your own salary, your holidays when you want to take them and return, it is the only true path to financial impendence and absolute freedom.

Sadly, it just remains as a dream for billions of people around the world, who are stuck with preconceived nonsensical notions of what is success and they are simply too lazy to get of their beds to take action due to their limiting beliefs of self-potential, their minds are deeply ingrained and corrupted by their bad programming within their subconscious and it doesn’t help with Internet guru’s selling “Get Rich” courses offering something for nothing, quick “you too can be rich”, buy this book, buy this seminar and you are on your way.

The real story is very false. Just think about it, if you really had ATM machine to churn out money like a golden goose, would you sell those secrets on a dime? Would you even have the time to hold seminars or masterclass coaching sessions. You definitely won’t. If you are a good successful trader, you would be trading since you are focused on becoming better at your own game.

It's taken me almost thirty years before I felt qualified to be able to put all my thoughts and perspectives into this book of what I have learned in my own journey of becoming a successful trader and lesson I have taken along with me and enough to say the least with conviction if you apply these ideas and disciplines in your trading strategy and in your life as well, success will always follow you.

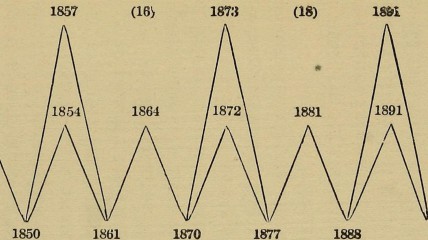

My life like my trading has been a beautiful journey of ups and downs and everything in between is a duration of a cyclical trend, at certain times you are winning in life, full of abundance and joy while the other side of the spectrum things are not doing that great, often it takes a great deal of observation of self and understanding of who you really are and what you are feeling at this particular moment which gives away the underlying phrase of the cycle you may be in.

Knowing nothing remains in the same position forever and stagnation in growth indeed means death for every type of life on earth and if you are not growing then you are regressing as in life so it’s in the markets as well and with some deep reflection, a repeated pattern of success or failure can be identified like a code of our own conduct they are repetitive in nature and determining on the results we will achieve, breaking out of these patterns often determines a change in the trend.

If yesterday and today is the same tomorrow is bound to be the same and therefore each part of our life phrase is nothing more than a cycle and if you want a change in the outcome you will need to change something today. Always probe your mind to know and learn the lesson of cynical patterns of life you are in and once the lesson from these repeated patterns is acknowledged and ownership taken the trend changes from worst to better and vice versa.

Trading successfully is less about the trade itself but more of market psychology and your beliefs, how your reactions play out in a certain situations is more of an important part then the direction of the market itself and on a relative basis psychology of a trader’s mind contributes more than 80% of becoming successful or self-destructive, while in life we could manipulate our existence for a preferred outcome, In the markets its very much different, the markets do not care on how you are feeling nor you could change anything about it to have a different outcome, its constantly evolving and adaptation of oneself is important, it’s a zero-sum game of someone losing for someone winning, it’s a winner takes all type of environment and each participant is trying to level up against another.

Today the markets have changed a whole lot from the day’s where each trader would be having his battle with another trader in the open cry pits of Chicago, the automation of trading has brought up a whole new set of challenges where most automated systems are operating on an upside down risk reward skew for a scalp on a few pips and running multiple rounds of scalps per trading day these have changed the dynamics of the market where the signals which used to be based on intuitive behavior of the participants in the markets are now replaced with sentiments and FOMO type of behavioral patterns where the markets are driven more than perception than actual reality and therefore air-pockets remain making crashes and rallies extreme and today markets are micro managed by central banks to keep the perceptive concept of value creation alive and when in actuality nothing can be further from the truth. {Further Reading: Animal Spirits}

Fortunately for me it’s been my passion and my calling right from the start where in the pursuit of happiness I met someone on the street in Hong Kong in the early 1990’s who suggested I take up a job as a Forex Broker and trusting the move I went in for the Interview and it was made clear to me there would be no salary for such a position but I could receive an allowance once I had a client, despite such odds, I took up a position with Frankwell Bullion Limited and quickly got onto the job of making cold calls trying to get a client, soon I learned the most of the retail clients were all losing money in the company and it was against what I had expected all along.

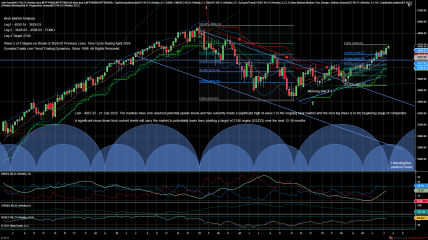

It has taken me a long journey to get here. I first launched my newsletter in Hong Long in 1994, Market Wrap as a means to support my subordinates team members and when I moved to Singapore to get closer to the market, there I launched Dynamictrader.com in the year 1997 as a means to support my clients with trade trend analysis and signals, it’s in these earlier days where technical analysis charting software were just getting increasingly popular with the likes of Meta Stock and Super charts allowed us to look for trends cycles and patterns with means to exploit buy and sell strategies and such could be had against vast amounts of historical data to look for similarities and with ease systems performance could be outputted within a short period of time outputting potential probabilities with definite risk reward ratio’s allowing traders to undertake positions with conviction and when TradeStation came along as an upgrade to SuperCharts, this became the first time trades could be automated for execution.

About me

The question has always risen is Trading successfully an art or a science, is it something which can be learned, observed and replicated or is it an inherent capability like a piece of art which only a few gifted persons have. If there is a word to describe this journey, then I would say it is a little bit of both.

Fortunately our trading house had a research department and the head of this Division, Mr Lincoln Lau, would do up newsletters and voice messages where clients would call in to know what happened in the overnight sessions and what to expect in the coming Asian and European sessions, I would spend time with Mr Lau to understand what he does and how he does it and today i am very grateful to him for introducing me key lessons of technical analysis and functionality of indicators.

Trading profitably is a journey of wins and losses. It takes dedication.

Experience is the best teacher in all cases, and we learn from mistakes created by others, identifying those mistakes in the future helps us to stay on course, it's often-said history repeats itself and this statement is written in gold, looking back at the Barings issue, Nick Lesson was buying a market that was in a down trend for more than 5 years. There are traders who using the dynamictrader concept are still looking to sell the Nikkei even today and identification of such trading levels is what makes dynamictrader unique.

In these last couple of years the US stock market have been having spectacular growth and the bull has taken charge of globe, with Asia breaking new grounds, Europe and north American markets are still seeing good growth levels with most advisors who were previously bearish turned bullish and then when a correction occurred suggestions to put holdings into cash are abound, how does one exit the market at a turning point and looking beyond this is what trend trading dynamics is about.

Trading the markets ought to be fun, and making money in the market has its own joys, the trend trading techniques of dynamictrader clearly states that trading and making money is the easiest part whereas cutting losses is the serious part, these money management techniques are based on the Asian capital preservation methods, which have been in place for centuries when trading first began.

Dynamic Trading concepts can be used in all markets including those that are seasonal or for day trading as long as the markets are liquid there lies an opportunity, in evident of this major funds are regularly seen active in all markets and not limiting oneself to a particular market, these concepts answers questions such as

Which markets should one trade ?

How much risk capital is required to trade a single market or trade ?

What techniques should be applied after a loosing trade? Identification of entry and exit levels.

How to identify a big move prior to its happening?

How to design and implement a trading system based on the trend trading dynamics concept?

What are almost zero risk trades and their identification?

All this data is reflected along with the trade signal issued on, over here we call it trader data, elsewhere its known as system performance reports. All this are provided in real time with approx.. 30 different trend trading.

Trading For A Living – Daniel Mankani

(Manuscript) (draft July 2023, still in progress. New Book Coming!)

All rights Reserved. Copyright information.

To be Continued. Last Updated 21st July 2023